A credit score to a legal responsibility account will increase its credit balance. Expenses normally have debit balances that are increased with a debit entry. Since bills are often rising, assume “debit” when bills are incurred.

Business

In enterprise, property can take several types — tools, patents, investments, and even cash itself. Here’s a rundown of the various kinds of belongings a enterprise can possess, and the kind https://cex.io/ of assets which might be thought of to be plant belongings. Plant assets are a specific type of asset on an organization’s stability sheet.

Is accounts receivable an asset?

Contributed capital is also referred to as paid-in capital. When a corporation issues shares of its stock for cash, the corporation’s current asset Cash will increase with the debit part of the entry, and the account Contributed Capital will increase with the credit part of the entry.

Typically a small-to-medium business keeps about $a hundred of cash available, however massive firms could have as a lot as $500, relying on their needs. It is mostly not a good suggestion to maintain an extreme amount of money readily available or too many individuals with entry to it as a result of threat of petty cash theft and potential accounting problems. Capital is a time period forfinancial property, such as funds held in deposit accounts and/or funds obtained from particular financing sources. Capital can also be associated with capital property of a company that requires vital quantities of capital to finance or increase. By having many revenue accounts and an enormous variety of expense accounts, a company will be capable of report detailed information on revenues and bills throughout the year.

In case of land and buildings, revaluation is fascinating as their worth generally will increase over time, and is carried out every 3 to 5 years. In case of plant & equipment, revaluation is carried out provided that there https://cryptolisting.org/ is a strong case for it. In case of depreciable belongings such as autos, furnishings & fittings or workplace gear, revaluation is not carried out.

How To Make Sure Your Business Lives Long After You Do

Because the balances in the momentary accounts are transferred out of their respective accounts at the end of the accounting 12 months, each temporary account may have a zero stability when the following accounting year begins. This signifies that the brand new accounting yr starts with no income quantities, no expense quantities, and no quantity https://cryptolisting.org/blog/what-are-plant-assets within the drawing account. As noted earlier, expenses are almost at all times debited, so we debit Wages Expense, increasing its account stability. Since your organization did not yet pay its workers, the Cash account isn’t credited, as an alternative, the credit score is recorded within the legal responsibility account Wages Payable.

There are different methods of assessing the financial worth of the assets recorded on the Balance Sheet. In some circumstances, the Historical Cost is used; such that the value https://beaxy.com/ of the asset when it was bought in the past is used because the monetary worth.

- Equity financing provides cash capital that is also reported within the fairness portion of the balance sheet with an expectation of return for the investing shareholders.

- Debt capital typically comes with decrease relative rates of return alongside strict provisions for repayment.

- Some of the important thing metrics for analyzing enterprise capital include weighted common cost of capital, debt to equity, debt to capital, and return on equity.

- Financial statements include the steadiness sheet, revenue assertion, and money circulate statement.

- Financial statements are written records that convey the enterprise actions and the financial efficiency of a company.

- Debt financing provides a cash capital asset that should be repaid over time through scheduled liabilities.

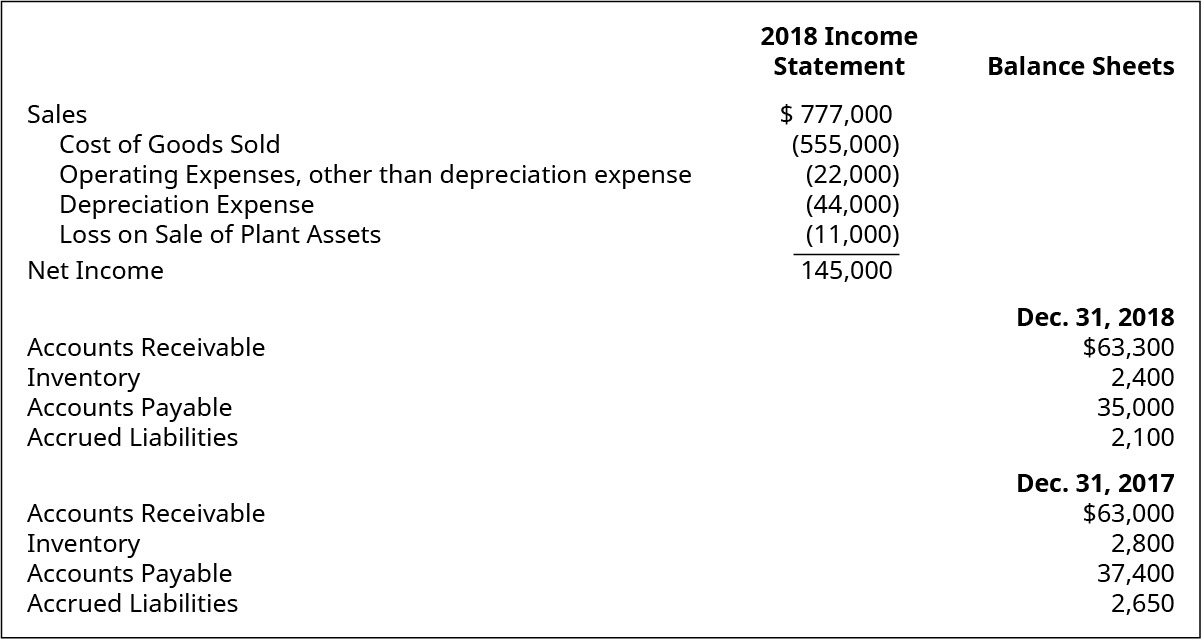

(We credit bills solely to reduce them, regulate them, or to close the expense accounts.) Examples of expense accounts embody Salaries Expense, Wages Expense, Rent Expense, Supplies Expense, and Interest Expense. In a T-account, their balances shall be on the left facet. Profit before tax as introduced in the earnings statement could be used as a starting point to calculate the money flows from working activities.

Is equipment on the balance sheet?

A house, like any other object that comes into your possession, is classified as an asset. An asset is something you own. A house has a value. Whether you assign the value as the price at which you purchased the house or the price at which you believe you can sell the house, that amount is how much your house is worth.

This might embrace vehicles and machinery, and in financial markets, options contracts which regularly lose time worth after purchase. An asset classified as losing could also be treated in a different way for tax and other functions than one that doesn’t lose worth; this may be accounted for by making use of depreciation. If the company then makes use of a few of its cash to buy what are net plant assets equipment, its current asset Cash will lower and its noncurrent asset Equipment will improve. They are recorded as an asset on the stability sheet and expensed over the useful life of the asset through a course of called depreciation. Capital property are property that are utilized in a company’s business operations to generate revenue over the course of a couple of year.

Cash circulate from working actions presents the motion in cash during an accounting interval from the primary revenue generating actions of the entity. accrual methodology of accounting, which data earnings and bills when you earn or incur them — no matter whether or not the cash has actually been exchanged. To function, you need working money circulate to meet payroll, make hire and insurance https://www.binance.com/ payments, and deal with the laundry list of different day-to-day expenses to keep enterprise running as usual. Even if your organization is worthwhile, you possibly can nonetheless be at risk of falling into financial demise. Broadly speaking, an asset is anything that has worth and can be owned or used to supply value, and may theoretically be transformed to money.

This is in accordance with usually accepted accounting principles fairness and transparency requirements for the presentation of accounts. If these adjustments affect the retained earnings account, the account must be adjusted by decreasing or growing (debiting or crediting) the account. For example, if an expense merchandise was not recorded in the previous interval, the accountant should create a journal entry that debits the retained earnings account and credits the relevant expense account. The normal stability of petty money can differ depending on the size of the company.

Asset

In other instances, the current honest market value of the asset is used to determine the value proven on the steadiness sheet. A wasting asset is an asset that irreversibly declines in value over time.

What does Total current assets include?

Equipment is not considered a current asset. Instead, it is classified as a long-term asset. Equipment is not considered a current asset even when its cost falls below the capitalization threshold of a business.